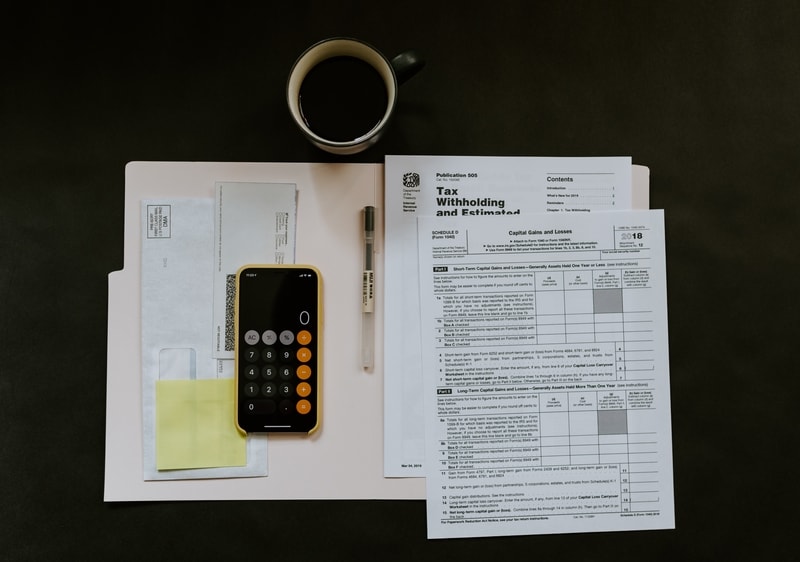

Tax season can be a hassle, but receiving a refund check in the mail often balances out the inconvenience. If you’re a senior 65 or older, you could get even more money back if you use all the deductions and tax credits you’re entitled to.

In this ultimate 2020 tax guide for seniors, see how to maximize your deductions, file for free, have a caregiver help, and how new tax laws apply to you.

When Do Seniors Have to File Taxes?

You’ll only have to file taxes on the money you earned in 2019 if you meet the minimum gross income requirements. This amount depends on your filing status and your age, and your Social Security benefits may or may not count as taxable income.

See the chart below to check if you have to submit a return this year.

| Individual Tax return | Minimum Income Requirements for Filing | |

| Under 65* | 65 or older | |

| Singe | $12,200 | $13,850 |

| Head of household | $18,350 | $20,000 |

| Married filing separately | $5 | $5 |

| Qualifying widow(er) | $24,400 | $25,700 |

| Joint Tax Return | Minimum Income Requirements for Filing |

| Married filing jointly, both spouses under 65 | $24,400 |

| Married filing jointly, one spouse 65 or older | $25,700 |

| Married filing jointly, both spouses 65 or older | $27,000 |

*If you were born before January 2, 1955, you’re considered to be 65 or older at the end of 2019.

Do Seniors Have to Pay Taxes on Social Security Income?

You’ll have to do a little math to figure out if your Social Security income is taxable. Here’s the quick, three-step process to find your answer.

Step 1

Add up your income from every source except your Social Security benefits. Include even funds that usually count as tax-exempt interest, such as interest earned on mutual funds.

Step 2

Take half of what you collected in Social Security benefits and added it together with step 1. You’ll know how much you received from the SSA-1099 form that the Social Security Administration sends at the beginning of the year.

Step 3

For those filing an individual tax return as single, head of household, or qualifying widow or widower:

If all your income and half of your Social Security totals:

- Less than $25,000: You don’t pay taxes on your Social Security benefits

- Between $25,000 and $34,000: Up to 50 percent of your benefits may be taxable

- Greater than $34,000: Up to 85 percent of your benefits may be taxable

For those married filing jointly:

If your total income and half of each other’s Social Security benefits totals:

- Less than $32,000: You don’t pay taxes on your Social Security benefits

- Between $32,000 and $44,000: Up to 50 percent of your benefits may be taxable

- Greater than $44,000: Up to 85 percent of your benefits may be taxable

Those married filing separately will probably pay taxes on their benefits. Instead, it’s most likely worthwhile to file a joint return if at any point last year you lived with your spouse. If you’re undecided about which filing status is the best for you, speak with a qualified tax professional.

If you want help determining whether you need to pay taxes on your benefits, the IRS’ interactive tool can let you know.

What Changes Are There for Seniors in the 2019 Tax Year?

While there weren’t significant tax reforms for the 2019 tax year, there are still some changes worth mentioning that could save you a lot of time and money. Here are some of the biggest, and how they can impact you.

Seniors have a new tax form

With the rolling out of the 1040-SR tax form, the IRS is giving people 65 and over a way to cut through multiple tax forms and make filing their taxes less complicated and more efficient. The form looks similar to the traditional Form 1040-A, but it has spaces to put in different types of income, credits, and deductions. There aren’t any income limits when using Form 1040-SR, so most seniors meeting the age requirement will be able to ditch the extra schedules and paperwork.

No more individual mandate penalty

In the 2018 tax year, you had to pay a penalty on your taxes if you didn’t have health insurance and didn’t qualify for an exemption. This rule took effect under the Affordable Care Act and was known as the “Individual Mandate Penalty” or the “Shared Responsibility Payment.”

If you’re filing for the 2019 tax year, the Shared Responsibility Payment doesn’t apply anymore. You’ll no longer have to pay any fines for the months you didn’t carry health insurance. No exemptions are needed to avoid the penalty.

Various adjustments for inflation

The IRS tries to ensure the amount of taxes you pay stays consistent by adjusting limits for inflation. There were a host of these adjustments made for the new tax year, including:

- Standard deductions increased $200 for singles and $400 for joint filers, bringing them to $12,200 and $24,400, respectively. Seniors 65 and older get between an extra $1,300 to $1,650 on top of the standard deduction.

- Tax bracket ranges grew, with increases of about two percent.

- Exemption for the alternative minimum tax also inched upward for a higher dollar minimum.

How Do You File Taxes as a Senior?

You can either file your taxes electronically or through the mail. An advantage of E-filing is that you get your refund in three weeks or less, as opposed to six to eight weeks when you file by mail. It’s also easier to make corrections on digital documents, and it’s quicker to submit your return since you avoid the long lines at the post office that typically accompany tax season.

To make filing your tax return quick, be sure to have all the documents you need next to you. Some things you’ll need to get started are:

- You and your spouse’s SSN or tax ID number

- Income sources forms such as the 1099-R for pensions, IRAs, and annuity income and 1099-SSA for social security income

- Mortgage interest statements

- Charitable donations receipts

- Health insurance 1095-A for insurance through the Marketplace

See H&R Block’s checklist for a complete list of documents to gather.

Where Can Seniors Get Taxes Done for Free?

The IRS lists two organizations offering free tax help that seniors can take advantage of; the Volunteer Income Tax Assistance (VITA) program and the Tax Counseling for the Elderly (TCE) Program.

VITA volunteers are IRS-certified and do basic income tax return preparations with electronic filing at no cost. Qualified individuals generally meet one or more of these criteria:

- Have an annual income of less than $56,000

- Have disabilities

- Are limited English speaking taxpayers who need help preparing their tax returns

TCE does free tax preparations for seniors aged 60 and older, with volunteers specializing in retirement- and pension-related questions and other tax topics unique to seniors. Like VITA volunteers, TCE volunteers are IRS-certified and are typically retirees themselves. They work through non-profit organizations and are reimbursed for out-of-pocket expenses through IRS grants.

The AARP Foundation’s Tax-Aide program operates most TCE sites and is open between January and April. You’ll find VITA and other TCE sites generally at schools, community centers, libraries, shopping malls, and other convenient locations in your town.

You can locate a Tax-Aide location with AARP’s locator tool or by calling (888) 227-7669. VITA and other TCE sites can be found with the IRS’ VITA/TCE locator tool. The IRS website advises to check back frequently if there isn’t a VITA or TCE site near you, as they’re always adding in new listings. Most VITA and TCE sites stay open from February until April, although some stay open as far as October.

Some test sites allow you to use a web-based tax preparation software for free if you’d prefer to prepare your own taxes and receive help from an IRS-certified volunteer if needed. You’ll find them labeled as “Self-Prep” in the listing.

Before you make the trip to a free tax preparation site, be sure to take a look at the complete list of services they offer and what to bring so you don’t waste a trip. Volunteers, for instance, won’t prepare a Schedule C with losses or a Form 8606 (non-deductible IRA).

What Can Seniors Deduct and Claim on Their 2019 Taxes?

There are several deductions and claims you can take advantage of while doing your taxes this year. Below are some of the most common.

Standard Deduction

A lot of people use standard deductions on taxes because it’s less of a hassle than itemizing. Those 65 or older have higher standard deductions. If you’re filing as single or head of household, you can add $1,650 to the regular standard deduction. Those filing jointly or with one spouse 65 and older can increase the standard deduction amount by $1,300. If both spouses are 65 and older, you get an additional $2,600 on top of the standard deduction.

You can also follow the same guidelines as above if instead of being 65 or older, you’re legally blind. To take advantage of this, you should keep on file a certified letter from your eye doctor confirming your condition.

Medical and Dental Expenses

The IRS allows you to deduct the portion of your medical and dental expenses exceeding 7.5 percent of your adjusted gross income (AGI). In general, payments for preventing, diagnosing, and treating diseases qualify, as do treatment payments for any structure or function of the body.

The IRS lists various examples of eligible expenses, including:

- Insulin

- False teeth

- Reading or prescription eyeglasses

- Acupuncture treatments

- Inpatient hospital care or residential nursing home care

- Health insurance premiums and long-term care insurance policies

To use this deduction, you’ll need to itemize rather than taking the standard deduction. Your itemized deduction amount must also be higher than your standard deduction amount.

Business Expenses

Many seniors enjoy working after formally retiring at age 65. They either continue running their own business or start new ones. You can deduct all your business expenses as long as the amounts are reasonable. If your company had a loss last year, you might also be able to deduct it from other income sources, like Social Security.

Elderly and Disabled Tax Credit

You may be eligible for up to a $7,500 tax credit if you were 65 or older at the end of 2019 or if you or your spouse retired on permanent disability. See Schedule R for a complete list of who can take the credit.

Your specific amount will depend on your filing status. One thing to keep in mind about this tax credit is your Social Security income and pensions can bring you over the maximum income limit. This tax credit is also non-refundable, meaning if the credit brings your tax bill below $0, the IRS won’t send you a refund for the rest of the credit.

How Can Caretakers Help Seniors File Their Taxes?

It’s 100 percent legal to have a caregiver complete and file your tax return if they have your permission. They don’t need any special qualifications so long as you’re not paying them for the service. If you do, the IRS requires them to have a PTIN. It’s crucial to know that you, and not the person who filled or filed your return, are liable if any information is incorrect. It may be more advantageous to have a qualified tax professional file your tax return to make sure it’s filled out correctly and that you get all the deductions and tax credits you’re entitled to.

If a caregiver does your taxes, they’ll need your:

- Information for all sources of income

- Personal identification information

- Self-employment and business records

- Medical expense receipts and records

- Documents relating to specific deductions, such as records of charitable donations, homeownership, and health insurance.

Filing Taxes as a Senior Doesn’t Have to Be Complicated

As a senior, you may not even need to file taxes at all if your income in 2019 was below a certain amount. If you do, you don’t have to go through the stress of filing your taxes because a VITA or TCE IRS-certified volunteer can do them for free. They can also ensure you take advantage of all deductions and tax credits applicable to you. If you’d rather do your taxes at home, a caregiver can help if you’d like. Use this 2020 tax guide for seniors to know how the new tax laws apply to you and what you can claim to get more money back.