Taxes can be very stressful, especially for caregivers. If you are a caregiver and are worried about filing your 2020 taxes, do not stress any longer. In this article, I will explain exactly what you need to do to file your taxes in the most stress-free way possible while maximizing deductions and tax credits.

The nation’s tax season starts a bit later this year (on February 12, 2021) to allow the IRS time to do additional programming and testing of their services. Following the December 27th tax law changes that provided a second round of economic impact payments along with other benefits, the IRS needs to account for these in their 2021 systems.

This extension will allow the IRS to ensure all refunds are paid out as quickly and problem-free as possible. Due to this extension, you still have time to prepare for the 2021 tax season, so let’s begin!

The 2021 Tax Season: What Has Changed?

The COVID-19 virus has made a significant impact on just about every part of our economy. Taxes were no exception. The federal government and the IRS have made significant changes this year to help those affected most by the Coronavirus. These changes include:

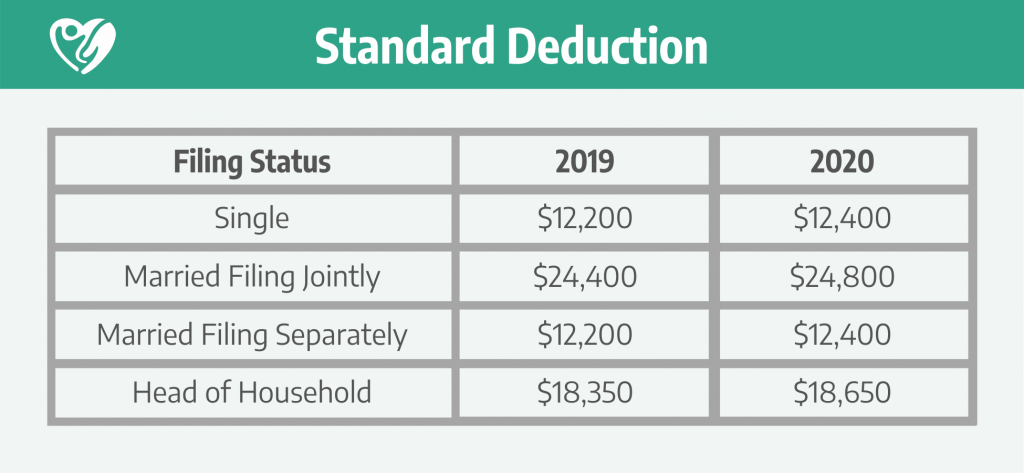

- Standard Deduction: The standard deduction, the portion of income that is not subject to taxes and can be used to reduce your tax bill, has been increased to $12,400 for single filers, $24,800 for joint filers, and $18,650 for Head-of-Household filers.

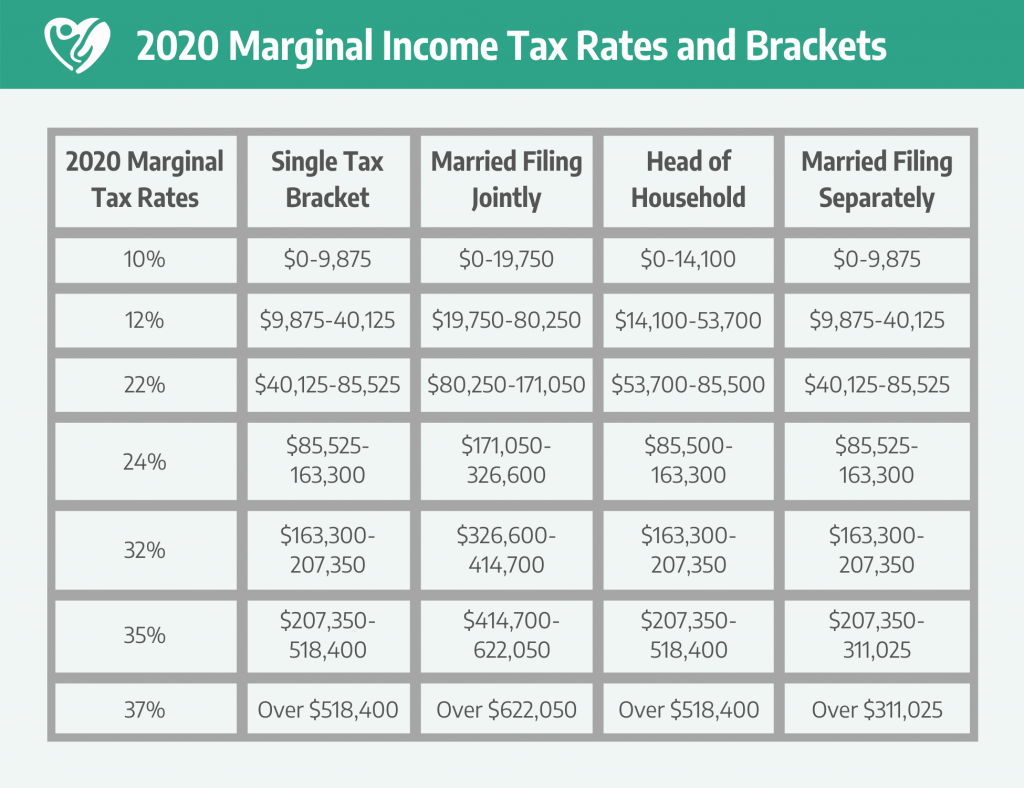

- Income Tax Brackets: To account for inflation, income tax brackets were increased. Your tax rate, which is the percentage of your income that you pay in taxes, is based on the tax bracket that you fall under. Tax brackets are based on your income range.

- Stimulus Checks: Most people received one or two stimulus checks in 2020 under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the COVID-Related Tax Relief Act. These stimulus checks are an advance payment of a special 2020 tax credit known as the recovery rebate credit, which means this is money you would have received anyway as part of your tax refund in 2021.

When you pay taxes, you can either take the standard deduction or choose to itemize your deductions. Tax deductions help lower how much of your income is subject to federal income taxes. Some deductions are only available to people who choose to itemize their deductions, while others are available through the standard deduction.

Itemizing – the process of calculating your deductions one by one – can be stressful and time-consuming. However, this method can be worth it if your itemized deductions are greater than the amount of the standard deduction.

Tax credits are another way to lower your tax bill. There are two types of tax credits, including:

- Refundable: If the tax credit is greater than the amount you owe, the difference is paid to you.

- Nonrefundable: Your tax bill will be lowered to zero, but you won’t receive a refund.

There are multiple tax credits and deductions that caregivers can take to lower their tax bill at the end of the year. But first, we need to decide what type of caregiver you are.

Independent Caregivers VS. Household Employees

There are two main types of caregivers: independent caregivers and household employees.

If you are a caregiver for your parent or another elderly loved one and are not being paid for your time, you are an independent caregiver. This also applies to caregivers who are paid less than $2,100 per year. If you are a caregiver that is paid more than $2,100 per year, you are considered a household employee.

If a family has hired you to be a caregiver for their loved one and are paying you more than $2,100, you are officially their employee, and they will take on all responsibilities of being an employer. These responsibilities include payroll and taxes.

The main difference between independent caregivers and household employees is who has control over the caregiver’s time. If you have control over what hours you work and the activities and services you provide, you are most likely an independent caregiver. If an employer hires you and controls your work hours, activities, and procedures, you are a household employee.

When filing taxes, independent caregivers will file Form 1099 to summarize payments they’ve received throughout the year as well as all taxes they’ve paid to the IRS. Household employees will file a personal income tax return using Form W-2. This shows wages earned and the taxes your employer withheld from you throughout the year.

Failing to properly classify as the right type of caregiver could result in you being audited and possibly being required to pay additional back taxes and fines. You can learn more about household employer taxes by reading Publication 926 from the IRS.

How To File Taxes As An Independent Caregiver

Depending on your situation, there are different ways in which you will file taxes as an independent caregiver. In the case that you are caring for a loved one and are being compensated for your time and energy through a trust, Medicaid, life insurance, long-term care insurance, or another form of income, you will need to file Form 1040 or 1040-SR.

In this case, you are not considered self-employed or an employee of a business providing senior care. However, this income is still taxable but is not subject to self-employment tax. You will need to report this income on line 21 of Form 1040.

Many adults wonder if they can get paid for the time they spend caring for their elderly parents. You can learn about the different ways you could get paid by reading Programs that Pay Children to Care for their Aging Parents.

Suppose you are a caregiver who acts as an independent contractor (i.e., you set your own hours and control the services you provide). In that case, you will need to file a Form 1099 to summarize the payments you have received throughout the year and the taxes you have paid to the IRS.

As an independent contractor who files a Form 1099, you have to pay twice as much in Social Security and Medicare taxes compared to a household employee.

How To File Taxes As A Household Employee

To file taxes as a household employee, first, understand that you are an employee. This means that your employer has a set of rules from the IRS and the state that they must follow. These rules mostly hold the family that hired you responsible for withholding federal income taxes, state income taxes, and Social Security and Medicare taxes.

A benefit that comes with being a household employee is 7.65% of your gross wages are withheld while your employer pays a matching 7.65% to the IRS. In comparison, independent caregivers have to pay the full 15.3% because they are self-employed.

When you are hired, your employer should give you a Form W-4 and a state withholding form if you live in a state with income taxes. If they do not give you this form, be sure to request it from them. This form determines how much in income taxes should be withheld each pay period. This amount is determined by what you claim when you fill the form out.

As you work for your employer, be sure to keep track of your hours and pay. Your employer should do this as well, but it is a good idea to keep track of this information. You should be given a pay stub for each pay period, which shows your gross pay, net pay, and the taxes withheld.

If you earned more than $2,300 during 2020, your employer should send you a Form W-2. This shows all the taxes they paid on your behalf. You will use this form to assist you in filling out your personal income tax return.

Finally, use the W-2 to fill out your personal income return by the April 15th deadline. If you cannot file your taxes on time, you can apply for an extension of 6 months using Form 4868. Just remember that the extension does not omit you from having to pay your taxes. You will need to estimate the taxes you owe and send in a corresponding payment when you file for the extension.

Caregiver Tax Deductions and Credits

Now that you understand how to file your taxes in 2021, you are probably wondering: are there any tax benefits that come with being a caregiver? I am happy to inform you that there are multiple different tax deductions and credits that you can file for to reduce your taxes or to increase your refund amount.

The current tax deductions include:

Charitable Deductions: If you plan on itemizing your deductions, the CARES Act allows you to deduct up to 100% of your Adjusted Growth Income (AGI) in qualified charitable donations. If you opt for the standard deduction, you can write off up to $300 of charitable contributions that you donated in cash.

Medical Deductions: Medical deductions can be very important for caregivers who are constantly purchasing equipment, medicine, and food for their loved ones. You can deduct medical expenses above 7.5% of your AGI as long as you choose to do itemized deductions.

Business Deductions: If you are a self-employed, independent caregiver, you can claim a bunch of different deductions on your tax return. The most common deduction for caregivers is travel expenses.

The current tax credits include:

Earned Income Tax Credit: EITC is a refundable tax credit that helps low- and middle-income workers get a little bit more back in their tax refunds. This credit is available to workers earning up to $56,844 during the 2020 tax year. Depending on your income, filing status, and how many children you have, this tax credit could save you anywhere from a couple hundred to a few thousand dollars on your taxes.

Credit For Other Dependents: This tax credit provides an extra $500 if your loved one qualifies as a dependent for tax purposes. For them to qualify as a dependent, you must have provided more than half of their financial support for the year. This includes purchasing food, utilities, health care, repairs, and more.

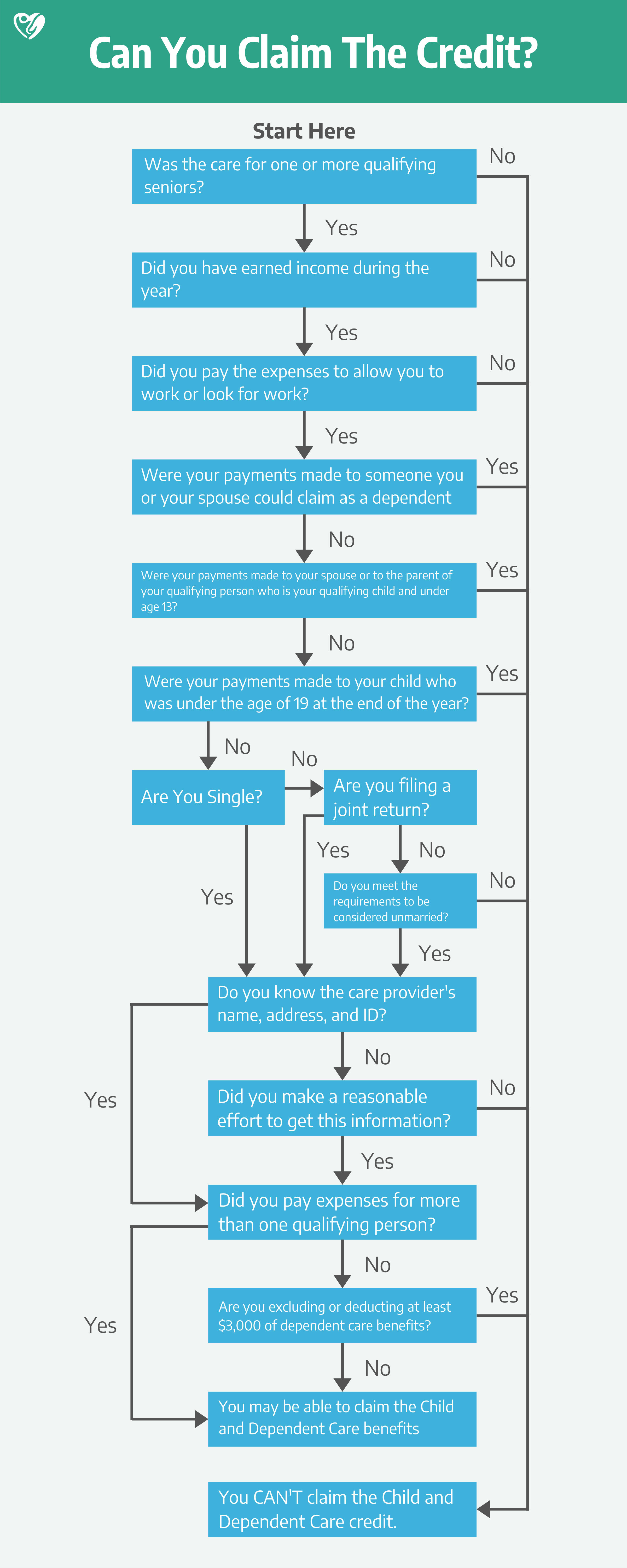

Child and Dependent Care Credit: If you were initially caring for your loved one and decided to hire another caregiver so that you could work or actively look for a new job, you could qualify for this tax credit that provides up to $3,000. Your loved one must have been physically or mentally incapable of self-care and lived with you for more than half the year. Additionally, you will be required to have earned income and to provide information about any care providers you hired.

Check out the chart below to understand if you are eligible to claim this credit:

Additional options include:

Dependent Care FSA (DCFSA): This is a pre-tax benefit account used to pay for eligible dependent care services, including in-home care, long-term care, and assisted living. This type of account takes money from your earnings before taxes are deducted and deposits it in a medical savings plan, which you can use to pay health care costs for your loved ones. However, if you pay for an expense using an FSA, you cannot take a tax deduction on that expense.

Keep in mind that when two or more people provide support to a relative, only one of those people can claim the person as a dependent. So if you and your siblings are helping to take care of your elderly parents, only one of you can claim them as your dependent. If you are the one that claims them, your siblings will have to sign a statement agreeing to not claim your parents as a dependent for the tax year.

It is a good idea to have a conversation with your siblings about taxes regarding caregiving before it is time to file taxes. This will ensure everyone is on the same page and everyone’s taxes are filed smoothly.

Additional Tips and Advice

Ok, now that you understand how to file taxes as a caregiver and what tax benefits you might qualify for, you are well on your way to successfully filing your taxes, stress-free. Take a look at these last few tips to help ensure your tax season goes smoothly and you get your well-deserved refund as soon as possible.

Document Everything: Whether you are an independent caregiver or a household employee, it is important to document everything. Keep all receipts and document all expenses regarding dependents you are caring for. If you are a household employee, track your hours and wages throughout the year.

Understand Who Qualifies As A Dependent: The IRS has specific rules to determine who is qualified as a dependent. You must support more than 50% of their living expenses, medical care, and more. Check out other guidelines on the IRS website.

Change Filing Status: Your filing status will determine how much taxes you have to pay or how much you will be refunded. If you were unmarried at the end of 2020 and can claim your elderly parent as a dependent, you can file your taxes as the Head-of-Household.

Determine If You Are An Employee or Self-Employed: Determine if you are an employee or self-employed. If you are an employee, make sure that your employer understands this and understands the responsibilities that come with being an employer.

The Bottom Line

In conclusion, taxes can be very stressful and complicated for caregivers. Determining whether you are an employee or are self-employed is one of the biggest stresses. After reading this article, you should understand exactly what type of caregiver you are, how to file taxes, and what tax benefits you might qualify for. This should allow you to file your taxes stress-free while maximizing deductions and tax credits.

If you enjoyed this article and are a caregiver, check out our guide on caregiver wages per state. This guide will show you if you are being underpaid for the work you do.